Blog

Private equity has had an incredible run over the past decade, delivering stellar returns that have outperformed public markets. However, as the Global Private Equity Report 2024 from Bain & Company highlights, maintaining that performance edge in today's higher interest rate environment will require a sharper focus on operational value creation.

The report points out that over the last 10 years, buyout funds, on average, have largely ignored margin expansion as a driver of value creation.

"Buyout funds on average have essentially ignored margin growth as a driver of value over the last decade and have been carried along by multiple expansion."

Bain & Company, "Global Private Equity Report," March 11, 2024

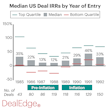

Sustained higher interest rates may take away the steady multiple expansion that has fueled buyout returns for the past decade

As detailed in the report, instead of pushing for profit margin improvement, the industry has leaned heavily on multiple expansion (selling the company at a higher valuation than it was purchased at, attributable more to industry tailwinds) and revenue growth to generate returns. In today’s rising rate environment, the former no longer works as a lever in the value creation tool kit.

"In a period of sustained high interest rates, however, maintaining performance will likely call on GPs to raise their game when it comes to value creation."

Bain & Company, "Global Private Equity Report," March 11, 2024

The good news is that top-quartile funds have demonstrated an ability to create value through operational improvements that boost profit margins.

"Top-quartile deals tend to have a different mix...margin improvement plays a significantly larger role than it does for the average fund."

Bain & Company, "Global Private Equity Report," March 11, 2024

Margin expansion is part of what gives top-quartile deals their edge

So what does this mean for private equity going forward? Generating outperformance will increasingly require rolling up one's sleeves to find opportunities to make portfolio companies leaner and more profitable through initiatives like:

- Optimizing pricing strategies

- Enhancing sales force effectiveness

- Driving operational efficiencies

- Pursuing product innovation

These initiatives to drive margin expansion will vary sector by sector. Nevertheless, the name of the game is shifting from financial engineering to operational excellence and organic growth. The firms that can marry their historical strengths in deal-making with enhanced capabilities in hands-on value creation will be best positioned to continue delivering for their investors.

Benchmark Your Value Creation Performance

Interested in benchmarking your firm's value creation capabilities? Connect with our analytics team to develop a sector-specific benchmark using DealEdge.

Read more

Sharpen your investment edge

Speak to us today and see how you can power up your private equity program

Request Demo