Blog

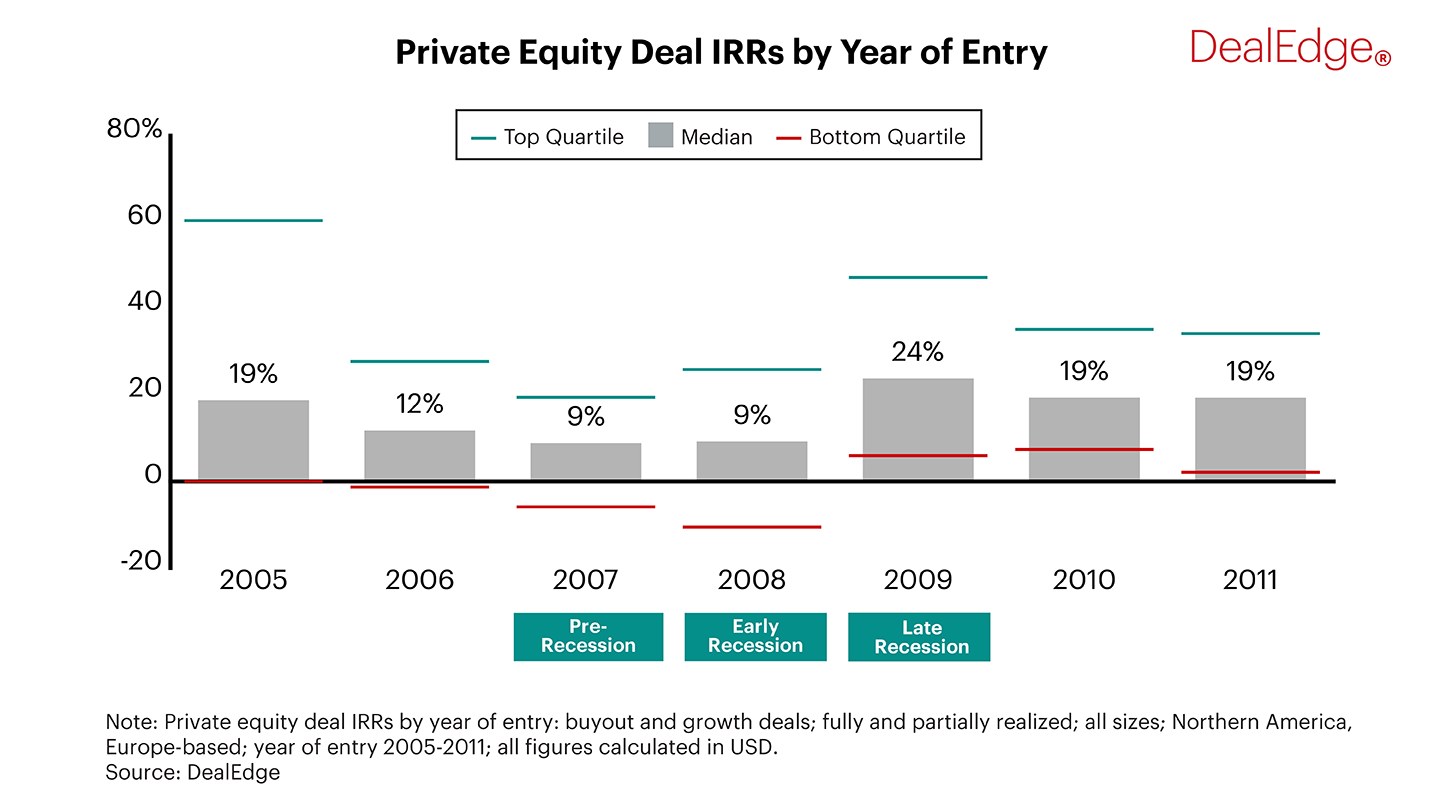

As the prospect of a global recession once again looms over financial markets, DealEdge has looked at how private equity deal performance was affected by the last major recession: the Global Financial Crisis (GFC) of 2008-9.

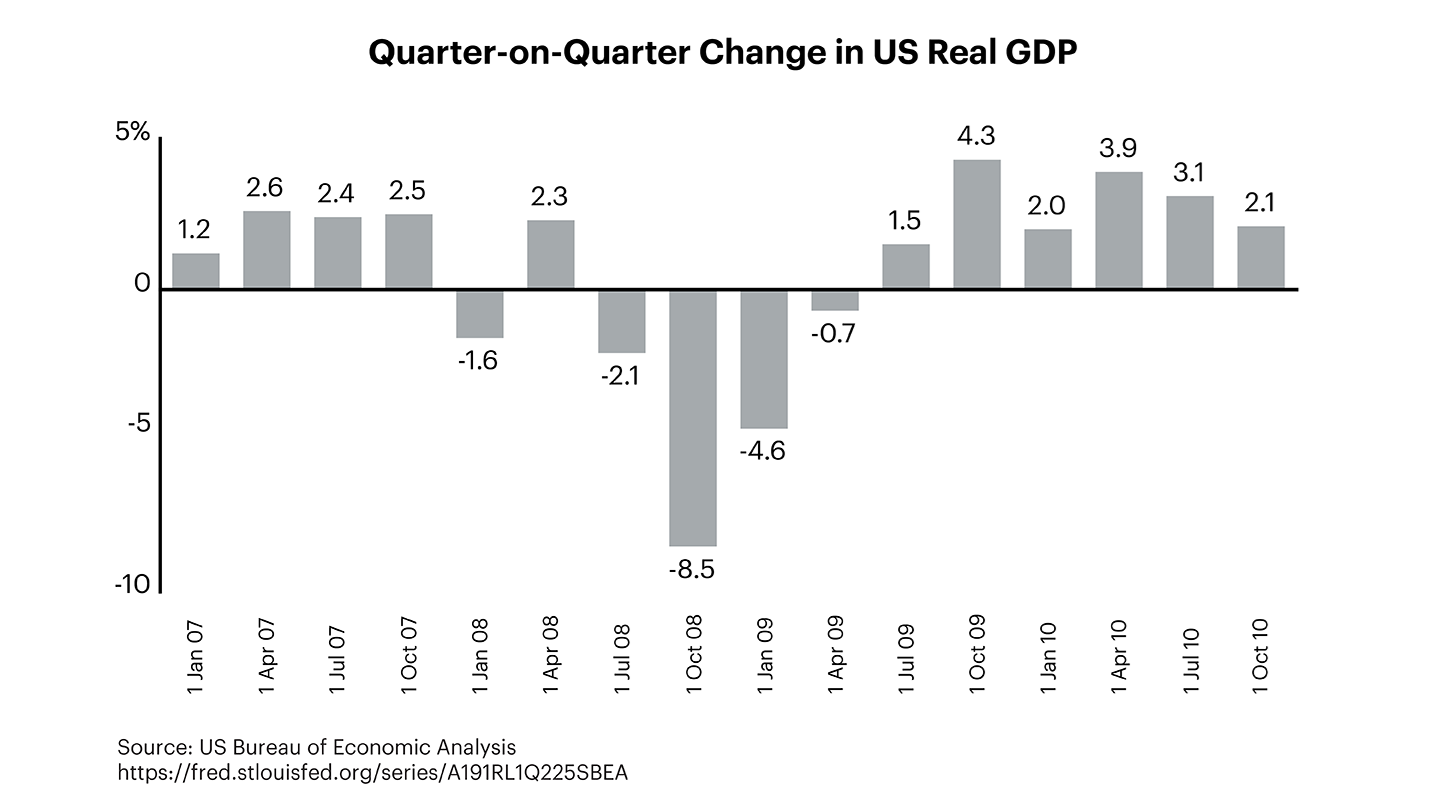

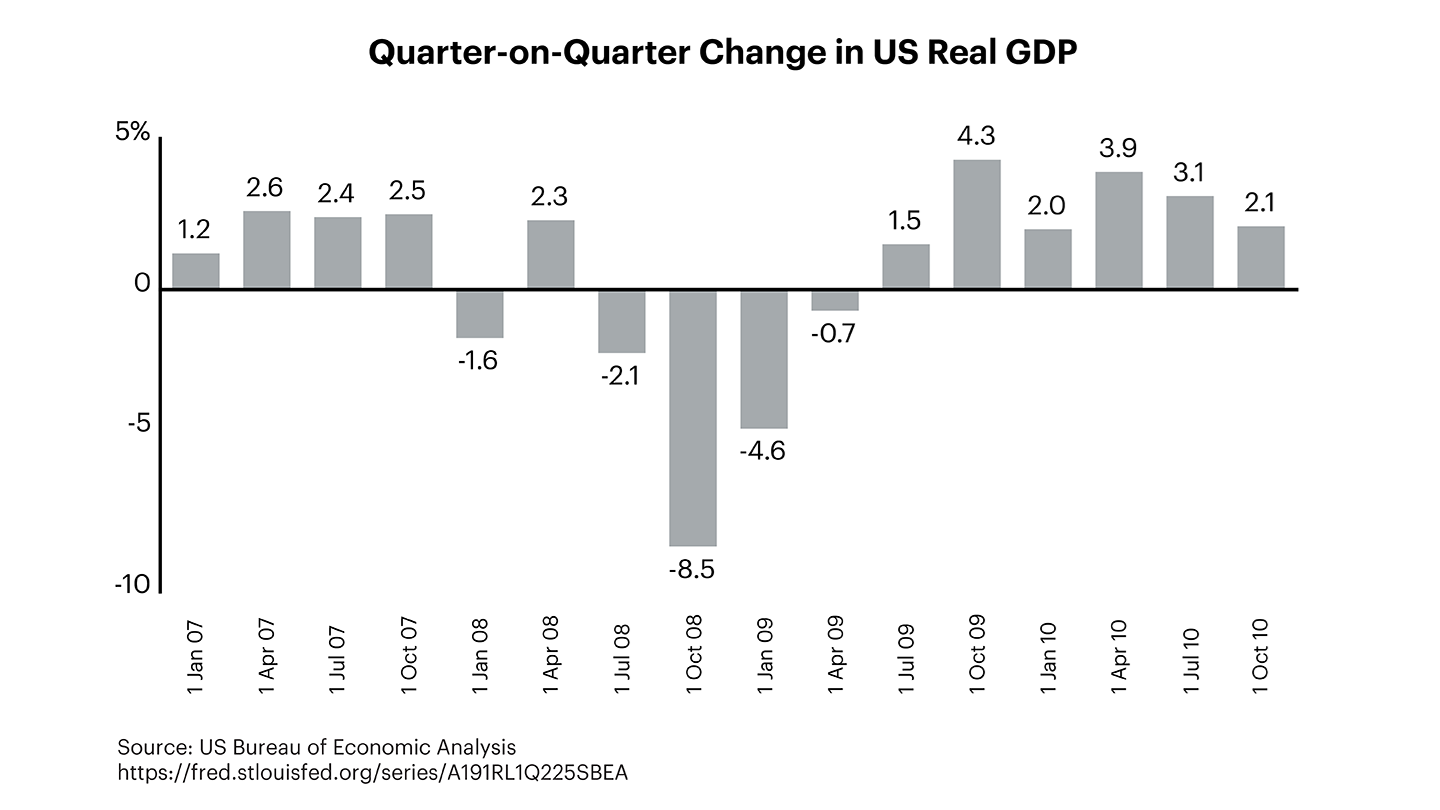

While the full effects of the GFC were felt for several more years, the US came out of recession in late 2009. As such, DealEdge has contrasted the returns of deals made both in the run-up to the recession, and during the recession itself, to see how private equity deals managed to adapt and recover.

Sign up to DealEdge insights

Register your details to receive DealEdge insights, analysis and updates directly to your inbox

- All quarters of 2007 saw positive growth, while 2008 had three out of four quarters that declined. Recovery began in Q3 2009, with further growth recorded through to the end of 2010.

- On that basis, DealEdge looked at three key stages of the recession:

- The run-up to the recession in 2007

- The early part of the recession in 2008

- The late part of the recession in 2009

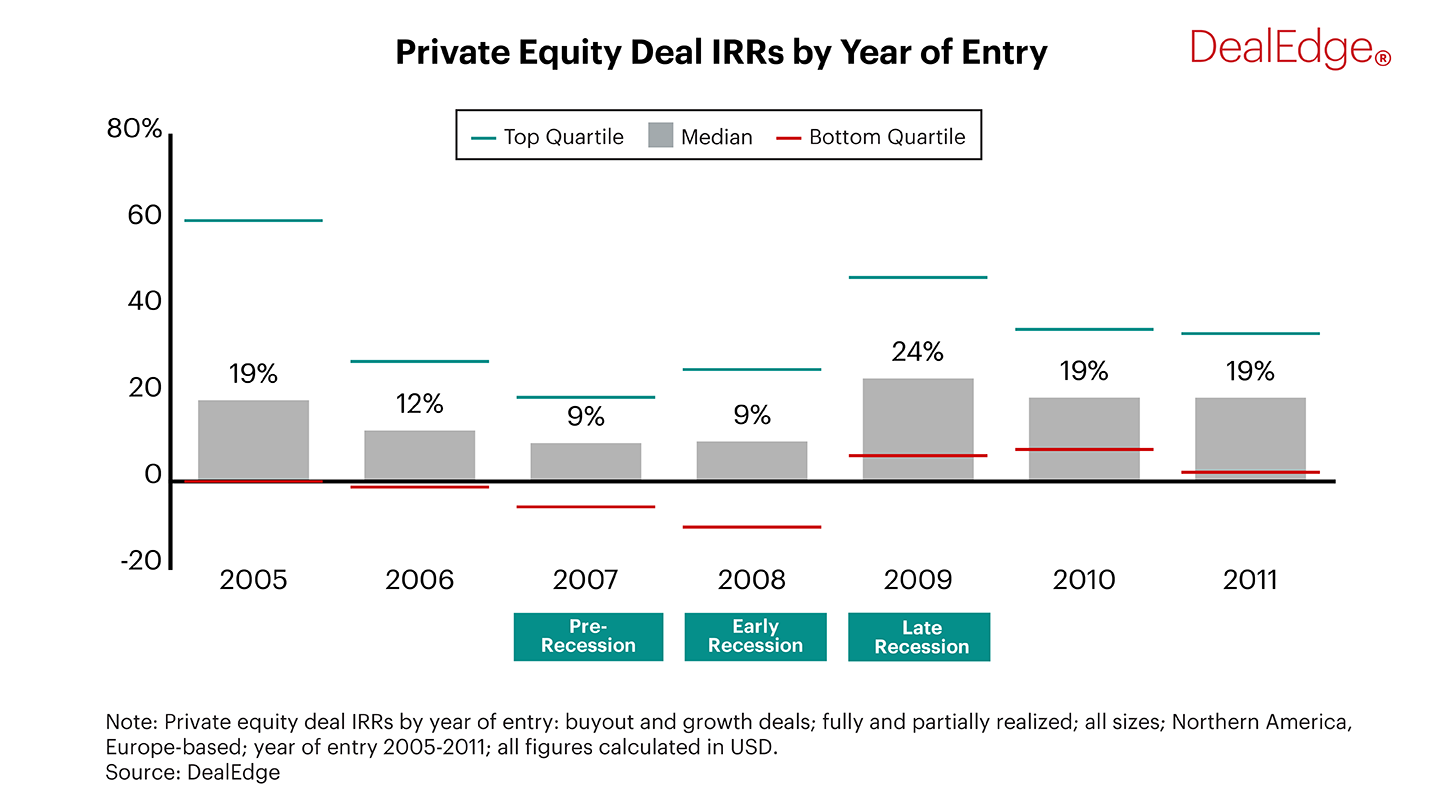

- We looked at buyout and growth deals made at each stage to examine how returns were impacted, and how quickly the industry as a whole was able to adapt to the Global Financial Crisis (GFC).

Get the full performance picture with the DealEdge Data Book: Private Equity Deal Performance Benchmarks

Download now

- Deals made during the run-up to recession in 2006 and 2007 had median returns of 12% and 9% respectively, significantly lower than those made after the recession had finished in 2010-11.

- During the recession itself, 2008 was a much more challenging performance year than 2009. 2008 deals posted a median IRR of 9%, on par with 2007, but saw bottom quartile performers sink to less than negative 11%.

- 2009, by contrast, posted the strongest median returns of any year either immediately prior to or after the recession. Top quartile returns rose to almost 50%, underlining the strength of the deals made that year.

The complete case study is exclusively for DealEdge Insights subscribers. To sign up, complete this form and download our Case Study: Private Equity Performance During a Recession.

Want to see which sectors performed the strongest in our recession case study today? Get custom breakdowns of performance and value creation by investment year, sector, region, size, and more. Request a demo.

Sharpen your investment edge

Speak to us today and see how you can power up your private equity program

Request Demo